Navigating through the complexities of filing a commercial auto insurance claim can be daunting. However, with Progressive's streamlined approach to the process, businesses can now experience a hassle-free and efficient claims journey. This guide delves into the key steps, documentation requirements, and customer support options provided by Progressive to simplify the commercial auto insurance claim process.

Overview of Progressive Commercial Auto Insurance Claim Process

When it comes to filing a commercial auto insurance claim with Progressive, the process is designed to be straightforward and efficient for customers. Here are the key steps involved in the Progressive Commercial Auto Insurance claim process:

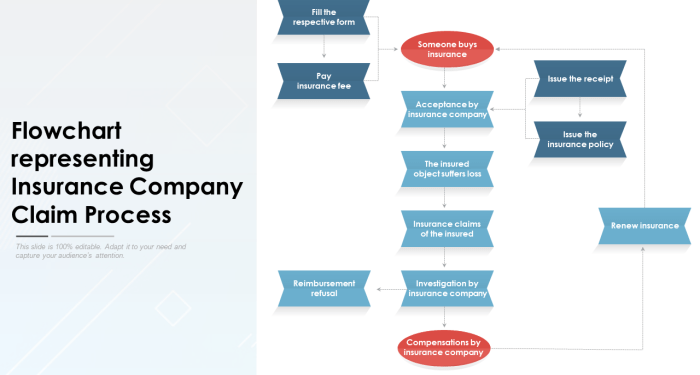

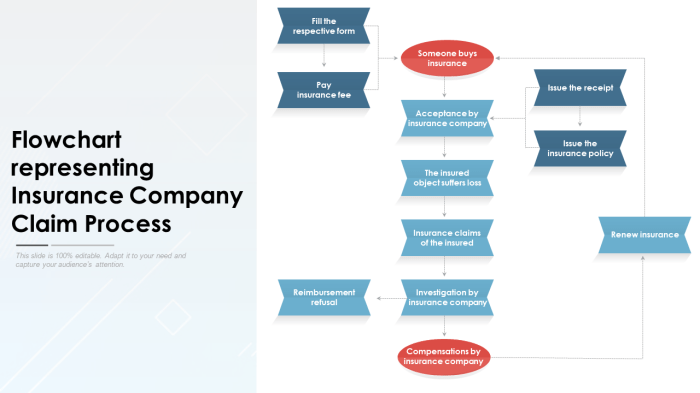

Key Steps in the Claim Process:

- Report the Incident: The first step is to report the incident to Progressive as soon as possible. This can typically be done online, over the phone, or through the Progressive mobile app.

- Provide Documentation: When filing a claim, you will need to provide documentation such as the police report, photos of the damage, and any other relevant information related to the incident.

- Assessment and Estimate: Progressive will assess the damage to your commercial vehicle and provide an estimate for the repairs or replacement.

- Approval and Payment: Once the claim is approved, Progressive will work with you to process the payment for the repairs or replacement of your vehicle.

- Resolution: Once the repairs are completed or a settlement has been reached, the claim will be closed, and your vehicle will be back on the road.

Documentation Required:

- Police Report: A copy of the police report filed at the scene of the accident.

- Photos: Photos of the damage to your commercial vehicle and any other vehicles involved in the incident.

- Witness Information: Contact information for any witnesses to the accident.

- Insurance Information: Details of your commercial auto insurance policy with Progressive.

Progressive’s Simplified Process:

- Online Tools: Progressive offers online tools and resources to help streamline the claims process for commercial auto insurance customers.

- Dedicated Claims Representatives: Progressive assigns dedicated claims representatives to guide customers through the claims process and provide personalized assistance.

- 24/7 Support: Progressive's claims support is available 24/7 to assist customers with any questions or concerns they may have during the claims process.

Filing a Claim with Progressive

When it comes to filing a commercial auto insurance claim with Progressive, the process is designed to be straightforward and efficient for business owners. Progressive aims to assist customers in navigating the claims process with ease to ensure quick resolution and minimal disruption to their operations.

Initiating a Claim

- Contact Progressive: The first step is to contact Progressive's claims department either online, through the mobile app, or by phone to report the incident.

- Provide Details: Be prepared to provide specific details about the incident, including the date, time, location, and any other relevant information.

- Document Evidence: Progressive may request documentation such as photos, police reports, or witness statements to support the claim.

- Claim Adjuster: A dedicated claims adjuster will be assigned to your case to guide you through the process and assess the damages.

Scenarios for Filing a Claim

- Accidents: In the event of a collision or accident involving your commercial vehicle, you may need to file a claim to cover repair costs.

- Theft or Vandalism: If your vehicle is stolen or vandalized, Progressive can help you recoup the losses through a comprehensive claim process.

- Weather Damage: Damage caused by severe weather conditions such as hail, floods, or storms may require a claim to repair the vehicle.

Progressive’s Assistance

- 24/7 Support: Progressive offers round-the-clock support for customers to report incidents and initiate claims at any time.

- Online Tools: Customers can use Progressive's online platform to document and track their claims, making the process more convenient and transparent.

- Expert Guidance: Progressive's claims adjusters are trained professionals who can assist customers in gathering evidence, assessing damages, and expediting the claims process.

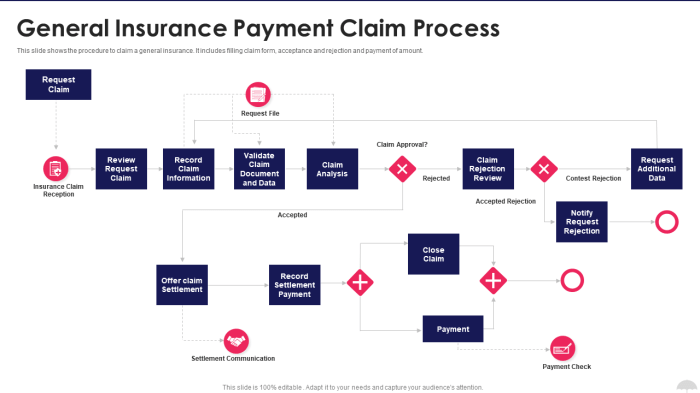

Evaluation and Processing of Claims

When a commercial auto insurance claim is submitted to Progressive, it undergoes a thorough evaluation and processing procedure to determine the settlement amount and ensure a fair resolution for all parties involved.

Evaluation Process

- Upon receiving a claim, Progressive assigns a claims adjuster to investigate the incident and assess the damages.

- The adjuster will gather information, such as police reports, witness statements, and any relevant documentation to determine liability and the extent of loss.

- Progressive may also conduct independent investigations or inspections to validate the claim and ensure accuracy.

Factors Influencing Claim Settlements

- The primary factor influencing claim settlements is the extent of damage or injuries sustained in the accident.

- Other factors include policy coverage limits, deductibles, and any applicable state laws governing insurance claims.

- The adjuster will also consider any pre-existing damage, previous claims history, and the overall circumstances of the accident.

Timeline for Claim Resolution

- Once a claim is submitted, Progressive aims to resolve it promptly and efficiently.

- The timeline for claim resolution can vary depending on the complexity of the case, the availability of information, and any disputes that may arise.

- In general, Progressive strives to finalize commercial auto insurance claims within a reasonable timeframe to provide timely assistance to policyholders.

Customer Support and Assistance

During the commercial auto insurance claim process, Progressive offers various customer support options to assist businesses in navigating the claims journey efficiently.

Communication with Customers

- Progressive provides regular updates to customers regarding the status of their claims through email, phone calls, or text messages.

- Customers can also track their claims online through the Progressive website or mobile app for real-time information.

- Claims representatives are available to answer any questions or concerns that customers may have throughout the process.

Smooth Claims Experience

- Progressive ensures a smooth and efficient claims experience for businesses by offering 24/7 claims reporting and support services.

- Customers can easily file a claim online or through the mobile app, streamlining the process and reducing paperwork.

- Progressive's claims adjusters work diligently to evaluate and process claims promptly, aiming to minimize disruptions to business operations.

- By providing personalized assistance and guidance, Progressive helps businesses navigate the complexities of the claims process with ease.

Ending Remarks

In conclusion, Progressive's commitment to customer satisfaction shines through its simplified commercial auto insurance claim process. By offering transparent evaluations, timely resolutions, and unwavering support, Progressive ensures a seamless claims experience for businesses. With Progressive, filing a commercial auto insurance claim has never been easier.

Questions and Answers

What documents are required when filing a commercial auto insurance claim with Progressive?

Progressive typically requires documentation such as the accident report, photos of the damage, and any relevant insurance policies.

How does Progressive communicate with customers regarding their claims?

Progressive keeps customers informed through various channels such as online portals, emails, and phone updates.

What factors influence claim settlements and payouts with Progressive?

Factors such as the extent of damage, policy coverage, and applicable deductibles can influence claim settlements and payouts.